- The Knight Cap

- Posts

- The Shrinking Supply of Stocks

The Shrinking Supply of Stocks

The Econ 101 Force Behind Higher Valuations

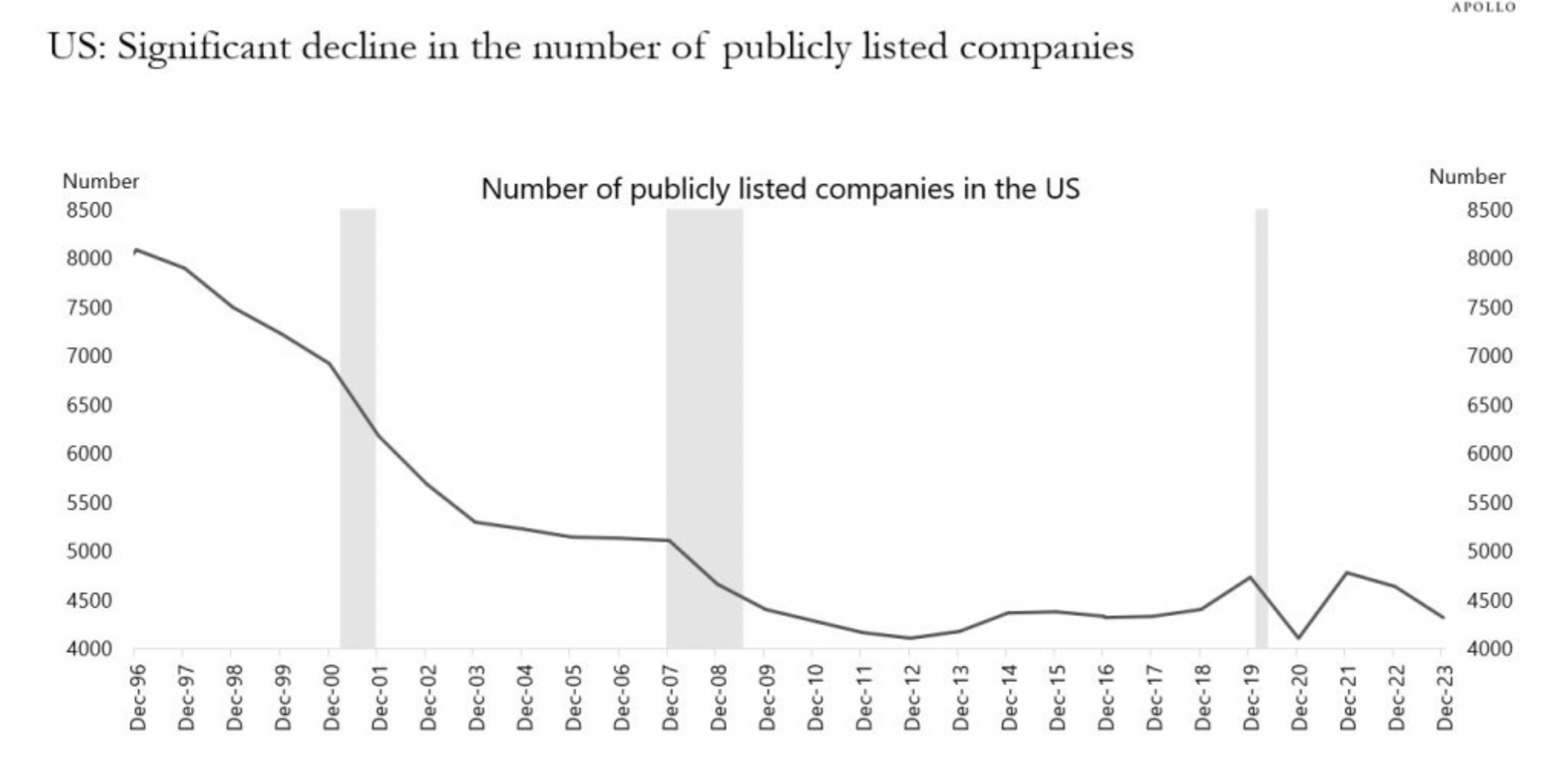

Over the past two decades, the supply of public equities has quietly declined even as global capital has surged. In the late 1990s, the United States had over 6,000 listed companies; today, that number is closer to 4,500, despite a far larger economy and market cap.

This is not just a fun fact. It is a structural driver of valuations. As Michael Cembalest of J. P. Morgan highlighted in his latest Eye on the Market, net equity supply has contracted since 2011. Buybacks, mergers, and fewer IPOs mean more shares are being retired than created, while investor demand from pensions, ETFs, and retail flows keeps growing.

The result is simple. More money is chasing fewer stocks. It is Econ 101. When supply is limited and demand rises, prices move higher. That imbalance helps explain why valuations remain elevated and may even offer a soft backstop if markets fall.

Even if earnings growth cools, structural scarcity keeps capital anchored in equities. Investors should focus less on comparing today’s multiples to old cycles and more on how shrinking supply and persistent demand redefine fair value.

In a world where equity supply keeps thinning, high valuations might not be a bubble. They might just be the new baseline.